Many people are concerned about mineral rights when purchasing land. While knowing what rights you have and do not have is essential, it is usually unfounded and nothing to worry about.

Many people desire to purchase land for hunting, camping, riding their horses, walking their dogs, building a homestead, or just relaxing. Most people don’t plan to start a mining business soon. This article will give you everything you need to know about mineral rights when buying land.

What are the risks if I don’t get the mineral rights when buying land?

Most people worry about being dug on if another person owns mineral rights to their property.

Although technically, this may be true, it is not the case in practice. Many of these rights to mine are historic. Mining companies would have mined the requests if they thought it was worth anything.

A mining operation can cost millions to set up and maintain. They wouldn’t start on a few 10-40 acre parcels. They would have to control thousands of acres and require consultations, permits, and paperwork. You would likely be offered an excellent deal for your land where you can make a significant profit.

A mining operation can cost millions to set up and maintain. They wouldn’t start on a few 10-40 acre parcels. They would have to control thousands of acres and require consultations, permits, and paperwork. You would likely be offered an excellent deal for your land where you can make a significant profit.

Don’t buy land, hoping you can sell it to a mining company. Most likely, any historical rights that might be available have been exploited or disregarded. Instead, look for a skilled oil and gas landman to help you buy land.

What is the difference between mineral rights ownership and surface minerals rights?

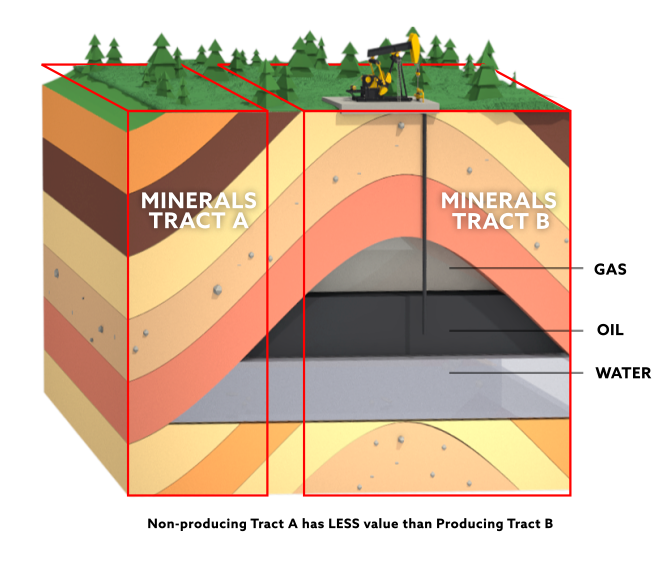

Mineral rights are the unrecognized value of a parcel of land when buying land. The royalty rights co-mingled in the land transfer were common in the past. These rights were first viewed separately when oil and gas production in the U.S. began.

Mineral rights can be severed. Separating mineral rights from surface rights begins.

Sometimes, confusion can arise when mineral rights and surface rights are owned separately. The surface rights owner has no input into oil and gas production. A royalty fraction, which is a payment of a percentage of the value of output, is established (i.e., A portion) and paid to the mineral rights owner.

Most land you purchase will give you the right to use the property’s surface minerals. This allows you to dig wells, build foundations, and till the land for agriculture. This is a common way to purchase the surface rights in extensive areas of Nevada, Texas, and Oklahoma.

You cannot begin a mining operation if you don’t own the unclaimed mineral rights to your land. You cannot lease your land or sell it to an oil company for exploration and extraction purposes.

How do I determine if I own the mineral rights when buying land?

All records should be available at the local county office. Take the time to review them and search for any language in the surface deeds that states the seller has all or some of the mineral rights on the land being sold. You can split the mineral estate from the surface estate, which is often done.

It is possible that the original owner of the land was granted both the mineral and surface rights in the purchase or claim to the land. However, the estate has likely been split over the years, particularly in areas with high oil and gas production.

There may be royalty deeds. These differ from mineral deeds in that they don’t transfer mineral rights. They only grant the right to a royalty on the minerals if they are produced. The royalty deed grantor would keep the actual ownership of the minerals. Therefore, the title to the minerals would not pass to the grantee.

It is possible that the same party did not own all the minerals on your land or only one party had them all. Therefore, you will need to track down all instances in which minerals have changed hands and identify who currently owns what.

This is not always easy. Landmen, lawyers, and other professionals are paid to research and prepare title opinions. A skilled landman often charges between $250-500 per day for “running title” for clients, plus expenses.

Do I have to look for land with mineral rights?

Be cautious about what you wish to achieve.

Like other assets, royalty rights are subject to tax. These tax burdens will vary depending on the production of the minerals. It can also tax minerals at the county and state levels and federal taxes.

The land will be much more expensive if you have mineral rights. You don’t have to be interested in mining the ground, which 99 percent of people do not. Keep it simple and focus on what you want.

Perhaps you are looking for flat, dry land where you can go camping.

Perhaps you are looking for rolling hillsides with dirt roads to ride ATVs on.

Do not be distracted by flashy objects. It will make it challenging to achieve your goals. Your dream property might be possible to purchase for as low as $3K-10K. It would be a skyrocketing price.

Can I sell mineral rights?

You must first own the mineral rights before you can sell them. This can cost hundreds of thousands of dollars in most cases. It’s just not worth it.

If you’re not interested in mining or aren’t a minor, check to ensure there aren’t any plans. Then move on with your plans. You can live off the grid, enjoy beautiful sunsets, hike in the woods, or simply live off the grid.

Open a mining business if you feel there is a danger of it happening. Call the county to make inquiries or hire a professional. Or, you can pay an abstract company to create a “take-off” for you. A “take-off” is a list of pages and books where you can find your property’s deeds or other conveyances.

It is possible to tell them you only want the documents that convey the mineral rights title and not a complete list which would include paid mortgages, land, oil and gas leases, etc. A “takeoff” is less expensive than a full abstract (which would comprise copies of the conveyances). It will save you time and effort searching the index books and determining which documents affected the title.

The take-off list could be brought to court with you, and you can go straight to the books. This will allow you to put together your chain quickly.

In some counties, there is no quality abstract office. It would be better to check the index books at your local courthouse. The court clerk’s office will usually be familiar with the location abstract office and can tell you if they are good or bad.

Final Remarks

Understanding land’s mineral rights are crucial when you buy it entirely. What are you buying? And what are your risks? Sometimes, however, the mineral rights issue can cost people months. They toss and turn at night, wondering if a large multi-national will knock on their tent to dig up their 20-acre parcel.

This is not what happens! Don’t obsess over things that don’t happen. Make a list of the criteria you want and the things you need, then move.