Most people have some kind of debt, whether it’s a phone they’re paying off, a credit card, or a mortgage. Borrowing money can be a useful way to pay for things that you can’t buy upfront, but too much debt can also get you into trouble. When you’re finding it hard to repay your debts or repayments are eating into your budget too much, it can become a problem. But if you want to deal with your debt, you have to make sure you’re doing it in the right way. There are many ways to go about it, and getting it wrong could make things worse and not better.

Understand Your Debt

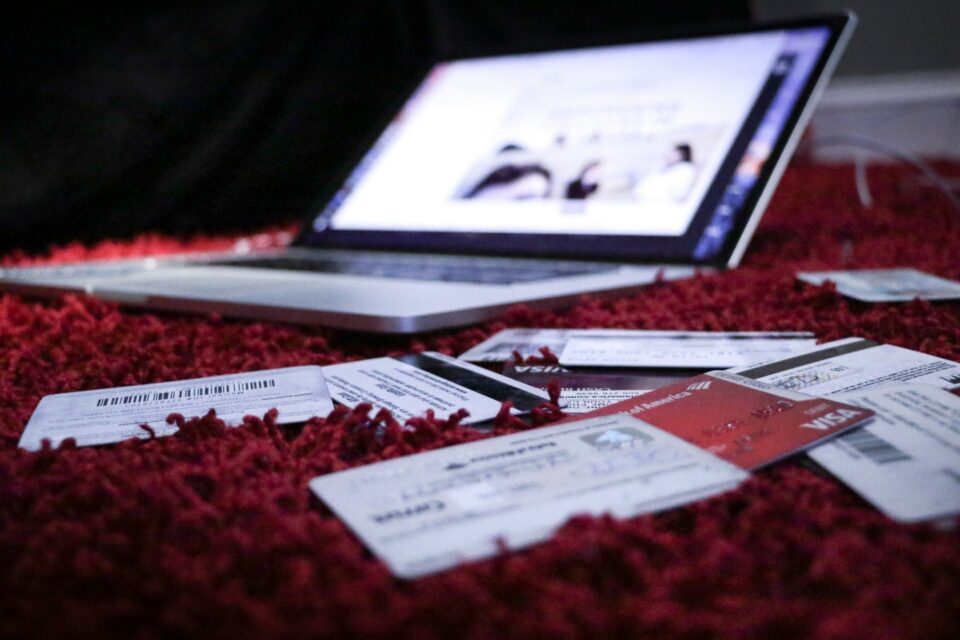

Understanding your debt is one of the most important things if you want to be able to deal with your debt. If you’re not sure what you owe, what the interest rates are, or what might happen if you don’t make your payments, you could end up in a mess. You should get a firm grasp on your different debts, starting by listing what you owe and who you owe it to. Write down how much you have left to pay, what the interest rates are, and when you expect to pay off each debt.

Get Professional Advice

When you’re dealing with your finances, getting advice from professionals is often the best thing to do. Not everyone thinks to ask for financial advice, especially if the service costs money. But you could save a lot more money by getting the advice you need. Take a look at Timberline Financial to find some tips for dealing with debt so you can get started. It’s especially important to get advice before choosing an option like bankruptcy debt relief. You need to make sure it’s the best choice for you, and expert financial advice can help.

Explore All Your Options

You always have a range of options when you want to deal with your debt in the right way. There are multiple solutions that you can use to help you pay off your debt, whether you’re struggling with a large amount of debt or you just want to pay off your debt sooner. For some people, debt consolidation could be the right choice. Debt management plans or debt relief plans could be the best option for others. It’s important to know what options you have so that you can decide which one can help you.

Don’t Delay

If you’re having problems with debt, the worst thing that you can do is try to ignore it. The longer you try to bury your head in the sand, the worse the problem can become. If you’re getting letters telling you that you owe money and you’ve missed payment, you need to do something about it. When your creditors are trying to get in touch with you, it’s better to try and talk to them to work out a solution than to ignore them.

Deal with debt in a smart way by making sure you know what your options are and what’s best for you.