Venmo has become a household name in the world of mobile payments, making it easier than ever to send and receive money from anywhere.

But have you ever wondered how Venmo makes money?

As a free-to-use mobile payment app, it may seem unclear how the company generates revenue.

However, in this article, we’ll explore the different ways that Venmo makes money, from transaction fees to interest on funds, and how the company’s business model has contributed to its tremendous success in the mobile payments space.

What is Venmo?

Venmo is a popular peer-to-peer (P2P) mobile payment app that allows users to send and receive money from their friends and family instantly. It was founded in 2009 and acquired by PayPal in 2013 for $800 million. Since then, it has grown in popularity and has become a go-to choice for many people in the United States to send and receive money.

Venmo is free to use and can be downloaded on both iOS and Android devices. The app’s 75 million users can link their bank accounts, debit cards, or credit cards to their Venmo accounts to transfer funds. The app also offers a Venmo card, which is a debit card that can be used to make purchases at merchants that accept Mastercard.

One of the unique features of Venmo is its social feed, which allows users to see and comment on their friends’ transactions. This feature has helped the app gain popularity and has made it more than just a P2P payment app. Venmo has also added features like bill payments and the ability to split expenses with friends.

How does Venmo work?

To send money on Venmo, users simply need to open the app, select the recipient, and enter the amount they want to send. They can then choose to pay using their Venmo balance, linked bank account, debit card, or credit card. Recipients receive a notification when they have been sent money and can transfer the funds to their bank account or use them to make purchases using their Venmo card.

Since its launch, it has gained tremendous popularity over the years and has become a go-to choice for many people in the United States to send and receive money from their friends and family.

But how does Venmo make money? Let’s see the different monetization methods.

Here’s a detailed guide on how Venmo makes money

1, Transaction Fees

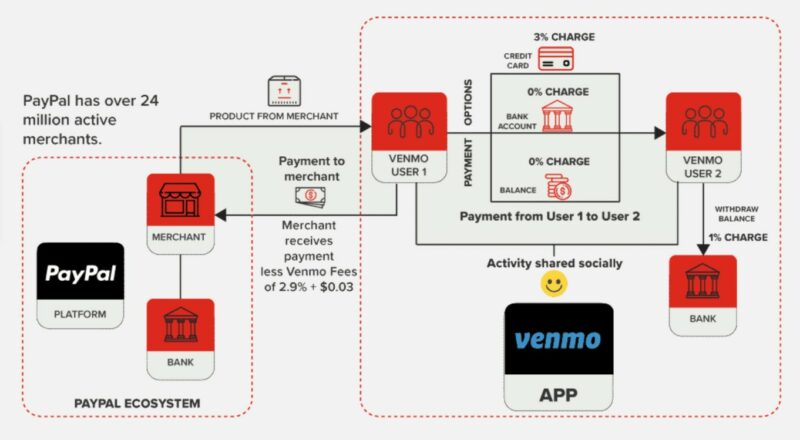

Venmo charges a 3% transaction fee on credit card payments. This fee is the primary way Venmo generates revenue. While bank transfers and debit card payments are free, Venmo charges a fee for using a credit card to fund transactions.

This fee covers the cost of processing credit card payments and allows Venmo to generate revenue from the large number of credit card transactions that take place on the platform. Additionally, Venmo may offer discounts on the transaction fee for businesses or users who process a high volume of transactions.

2, Instant Transfer Fees

Venmo allows users to transfer money instantly to their bank account for a fee of 1%, with a minimum fee of $0.25 and a maximum fee of $10. Instant transfers are a convenient feature for those who need access to their funds quickly, and the fee helps Venmo generate revenue.

This fee allows users to access their funds immediately instead of waiting for the standard one to three business days for the transfer to process. This service is particularly useful for users who need quick access to their funds, such as freelancers or gig workers.

3, Venmo Credit Card

Venmo launched its own credit card in 2020, which allows users to earn cashback rewards on purchases. Venmo earns revenue from the interchange fees charged to merchants for each transaction made with the Venmo credit card. Additionally, Venmo earns revenue from interest and fees charged to users who carry a balance on their credit cards.

4, Interest on Funds

Venmo holds user funds in an FDIC-insured account and earns interest on these funds. This interest is one of the ways Venmo generates revenue without directly charging its users. The interest earned on these funds is relatively small, but it adds up over time, especially considering a large number of users and the volume of transactions that take place on the platform.

5, Merchant Fees

Venmo also charges merchants a fee for processing payments. This fee is typically around 2.9% of the transaction amount, plus a fixed fee per transaction. This fee helps Venmo cover the cost of processing payments and contributes to its overall revenue.

6, Subscription Fees

Venmo could potentially offer premium features for a monthly or yearly subscription fee. For example, Venmo could offer users the option to increase their transaction limits or access additional security features for a subscription fee.

The company could also offer financial planning tools or budgeting software for users who pay for a subscription. By offering these additional features for a fee, Venmo could generate additional revenue and increase customer retention.

7, Advertising

Venmo’s social feed could be used as an advertising platform for targeted ads. While some users may find ads to be intrusive, they can be an effective way for companies to generate revenue. Venmo could use user data to display relevant ads to users and generate additional revenue from advertisers.

For example, a user who frequently makes purchases at a certain retailer could be shown ads for that retailer on their Venmo social feed.

8, Partnerships

Venmo could partner with other companies to offer discounts or cashback rewards to users who use their Venmo accounts to make purchases. This could be a win-win situation for both Venmo and its users. Venmo could earn a commission from the partner company for each purchase made using a Venmo account, while users could receive discounts or cashback rewards for using their Venmo account to make purchases.

This would encourage users to use Venmo more frequently and generate additional revenue for the company.

9, International Payments

Venmo is currently only available in the United States, but the company could explore the option of expanding its services to other countries. Venmo could charge a fee for international transactions, similar to the fees charged by other payment processors.

Venmo could also offer currency conversion services, allowing users to send and receive payments in different currencies. This would make Venmo more attractive to international users and generate additional revenue for the company.

10, Data Analytics

Venmo could leverage the vast amount of data it collects from its users to offer data analytics services to other businesses. Venmo could use its data to provide insights into consumer spending habits, trends, and patterns, which could be valuable information for businesses looking to understand their target audience.

Venmo could charge businesses for access to this data or offer data analytics services for a fee. This would be an additional revenue stream for Venmo and could also provide additional value to its users by offering personalized recommendations or insights into their own spending habits.

What is Venmo’s business model to make more money?

Venmo’s business model is built around customer retention and maximizing profits by creating a user-friendly and seamless experience for its customers while also monetizing various aspects of its platform.

Here’s how Venmo tries to achieve these goals:

User Experience

Venmo has become popular due to its user-friendly and seamless experience. The app is easy to use, and transactions are processed quickly, making it an ideal choice for people who want to send and receive money without any hassle.

Venmo also offers a social feed where users can see and comment on their friends’ transactions, making it a more engaging experience than traditional payment platforms.

Monetization Strategies

Venmo monetizes its platform in several ways, including transaction fees, instant transfer fees, merchant fees, interest on funds, and its credit card. By diversifying its revenue streams, Venmo can maximize profits while also offering users a variety of payment options.

Venmo monetizes its platform in several ways, including transaction fees, instant transfer fees, merchant fees, interest on funds, and its credit card. By diversifying its revenue streams, Venmo can maximize profits while also offering users a variety of payment options.

Customer Retention

Venmo has built a loyal customer base by offering incentives to users. For example, Venmo offers cashback rewards to users who make purchases with its credit card, encouraging them to use the app for more than just P2P payments. Venmo also offers a rewards program where users can earn points for certain transactions, which can be redeemed for discounts and other rewards.

Innovation

Venmo is constantly innovating and adding new features to its platform to stay ahead of its competitors. For example, Venmo recently introduced the ability to buy and sell cryptocurrency, which allows users to invest in digital assets directly from their Venmo account. This feature not only appeals to tech-savvy users but also provides another revenue stream for Venmo.

Branding

Venmo has built a strong brand identity that appeals to its target audience. The app’s fun and quirky branding resonates with millennials and younger generations who are more likely to use P2P payment apps. Venmo’s branding also creates a sense of community among its users, which helps to foster loyalty and retention.

Interesting Details about Venmo

- Venmo was acquired by PayPal in 2013 for $800 million. This acquisition helped PayPal expand its reach in the mobile payments space.

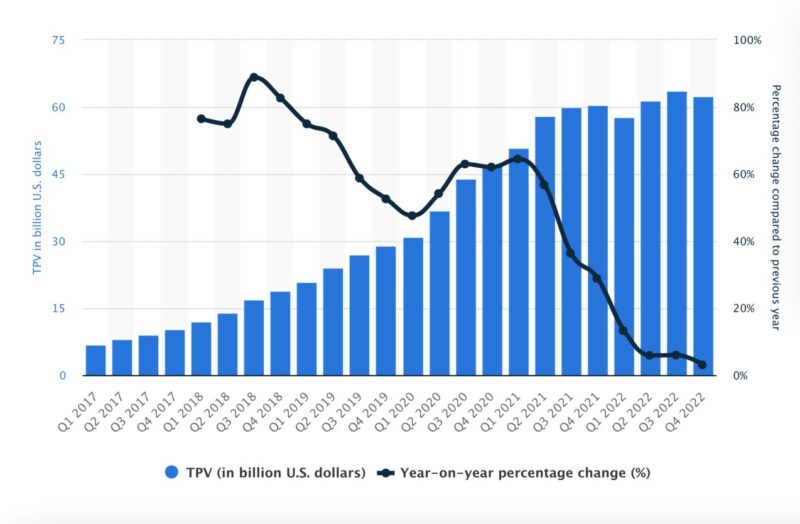

- Venmo’s popularity has skyrocketed in recent years, with the app processing more than $100 billion in transactions in 2020.

- Venmo has become more than just a P2P payment app. It has also added features like bill payments, the ability to split expenses with friends, and even a social feed where users can see and comment on their friends’ transactions.

- Venmo’s social feed has been both a blessing and a curse. While it has helped the app gain popularity, it has also raised concerns about privacy and security.

Conclusion

In summary, Venmo’s business model is focused on providing a seamless user experience, monetizing its platform in various ways, retaining customers through incentives and rewards, innovating and staying ahead of competitors, and building a strong brand identity that resonates with its target audience.

By doing so, Venmo has become a leading P2P payment app and has become a go-to choice for many people in the United States to send and receive money from their friends and family.