In the dynamic landscape of real estate investment trusts (REITs), a realm often associated with lucrative investment potential, an equally thriving job market awaits those seeking diverse career paths. From asset management and property operations to finance and legal roles such as lawyer or bondsman and beyond, the world of REITs offers a spectrum of job opportunities.

Just like in our earlier article about investment managers, we delve into the intriguing question:

How many jobs are available in the thriving ecosystem of real estate investment trusts?

Join us as we unravel the various sectors and roles within REITs that contribute to the expansive employment opportunities in this ever-evolving industry.”

What are Real Estate Investment Trusts?

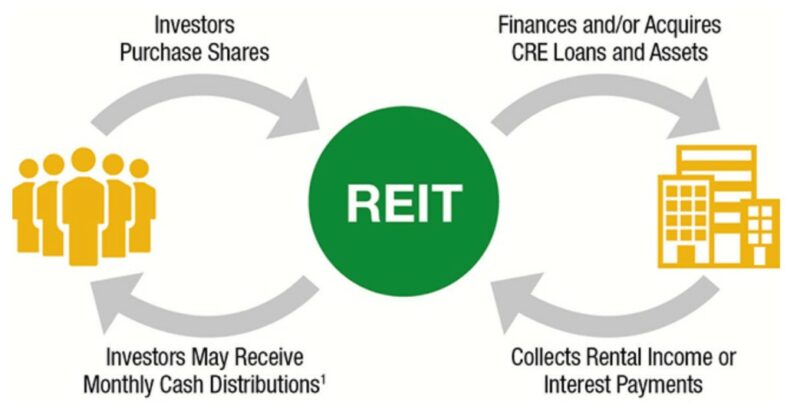

Real estate investment trusts (REITs) are a popular investment vehicle that enables investors to invest in real estate without owning physical properties. Instead, investors purchase shares in a REIT that owns and manages a portfolio of real estate properties such as office buildings, apartments, shopping centers, and hotels.

REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, which makes them an attractive option for income-seeking investors.

Who counts as a REIT professional?

REITs have been around for over six decades and have grown to become a significant player in the real estate industry. As of 2020, there were 225 REITs listed on major U.S. stock exchanges, with a total market capitalization of over $1 trillion. The growth of the REIT industry has led to an increase in the number of jobs available in various sectors.

The number of jobs available in REITs can vary depending on several factors such as the size and type of the REIT, market conditions, and the specific roles and functions within the organization. Generally, REITs employ professionals from a wide range of fields such as finance, accounting, law, real estate, and asset management.

Portfolio Managers

One of the most critical functions within a REIT is the portfolio management team. Portfolio managers are responsible for identifying real estate investment opportunities and managing the existing portfolio of properties.

They analyze market trends and financial data to determine which properties to invest in and which ones to sell. Portfolio managers must have a deep understanding of the real estate market and the financial principles that drive investment decisions.

Data Analysts

Another essential function within a REIT is the analyst team. Analysts are responsible for conducting market research and financial analysis to support investment decisions made by the portfolio management team. They analyze financial data such as income statements, balance sheets, and cash flow statements to evaluate the financial health of potential investment opportunities.

Asset Management

REITs also employ professionals in asset management roles. Asset managers are responsible for overseeing the day-to-day operations of properties within a REIT’s portfolio. They work closely with property managers to ensure that properties are well-maintained, tenants are satisfied, and the properties are generating income.

Real Estate

Real estate agents are another critical part of the REIT industry. They are responsible for identifying potential properties for acquisition and selling properties owned by the REIT. Real estate agents must have a deep understanding of the real estate market and be able to negotiate deals that are beneficial for the REIT.

In addition to these primary roles, REITs also employ professionals in supporting roles such as human resources, marketing, and administration. These roles are essential for ensuring that the organization runs smoothly and that employees are supported in their day-to-day work.

How many jobs are there in Real Estate Investment Trusts?

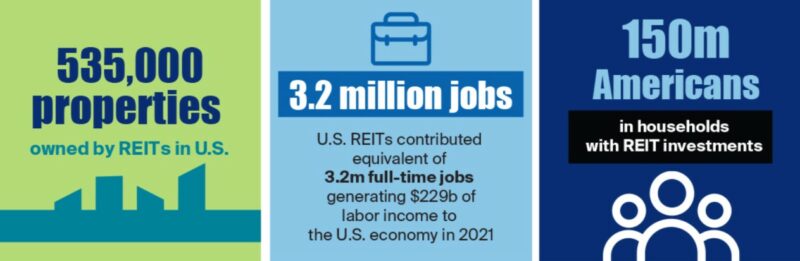

When looking at all these roles, the number of jobs available in REITs is difficult to quantify as it can vary depending on market conditions and the size and type of the REIT. According to the National Association of Real Estate Investment Trusts (NAREIT), as of 2020, there were approximately 330,000 individuals employed by REITs across various sectors.

However, this number only includes publicly listed REITs in the United States and does not necessarily represent the full scope of the job market in REITs. According to REIT’s own data, they supported 3.2 million jobs across all sectors in 2021.

Overall, the REIT industry provides a significant number of job opportunities across various sectors such as finance, accounting, law, real estate, and asset management. As the industry continues to grow, the number of jobs available in REITs is likely to increase, providing a promising career path for individuals interested in the real estate industry.

Conclusion

Generally speaking, REITs employ professionals from a wide range of fields such as finance, accounting, law, real estate, and asset management. Some of the typical job roles found in REITs include portfolio managers, analysts, financial controllers, property managers, asset managers, and real estate agents.

Additionally, there are supporting roles such as human resources, marketing, and administration.