The world of investing in stock markets and currencies has been cracked wide open after several platforms have been made available for anyone who’d like to make a quick buck. Of course, this will not be your ordinary guide to fund your Wolf of Wall Street style of living.

And the world of stockbrokers is fraught with some risks. But it is a good start for anyone who feels like they have the talent, intuition, or luck to make it. You can do it all by yourself with the help of the online market trading platform we have listed, Etoro.

Before you plunge yourself deep into this topic it is crucial that you do your research. Around 76% of amateur or beginner traders lose a certain portion of their money. Never invest more than you’re willing to lose. It is no rocket science that you have to be up-to-date with the market’s intricacies.

(If you want to know how to avoid falling into the 76% pit, keep reading. Study the market and observe the actions of other traders! The following content is aimed at introducing and educating, and should not be considered as investment advice or recommendations. What we show here are the basics to get started and some hints at how to manage your accounts.)

At the end of 2017, eToro announced, it had opened around 8 million accounts. Throughout its operation from 2006 in Tel Aviv, it has become the largest trading platform online.

Registration

No thick folders crammed with papers requiring hours of scribbled signatures. Signing up is free and straightforward like many other online applications. Just enter your details and choose a username. In order to protect your account, they ask for a phone number.

And whoala!

You are now open to the world of real-time trading.

Getting to know the Platform

Here is a quick overview of the main sections, displayed to your left on your dashboard. I will run through each of them quickly, explaining what they are in short detail.

Portfolio: This is a display of all your open trades, revealing your values and your performance.

News Feed: This is where you can see everything the traders you follow have been doing and their most recent comments.

Trade Markets: This is where you go to research and trade in the markets available to you: stocks, currencies, commodities and indices and exchange-traded funds (ETFs.)

Copy People: This what makes this trading platform different: the community. You have to search through other traders who you may want to copy or follow.

Observe, Learn and Copy other good traders

These are our recommended steps for beginners. Observe, learn, and copy! When you skim through the profiles of traders, every trade they execute is simultaneously opened in your account too, and then closed when they close it.

There are many useful filters to help narrow down to the results you want, such as markets and performance. Your earnings will be proportional to the percentage of your total account’s funds you choose to allocate to them, but ultimately you will achieve the same rate of return as they do.

However, finding reliable traders to follow and copy isn’t always as easy as it seems. You need to know what to look for and what to stay clear of. Here are some ideas for you to consider.

Avoid these common mistakes

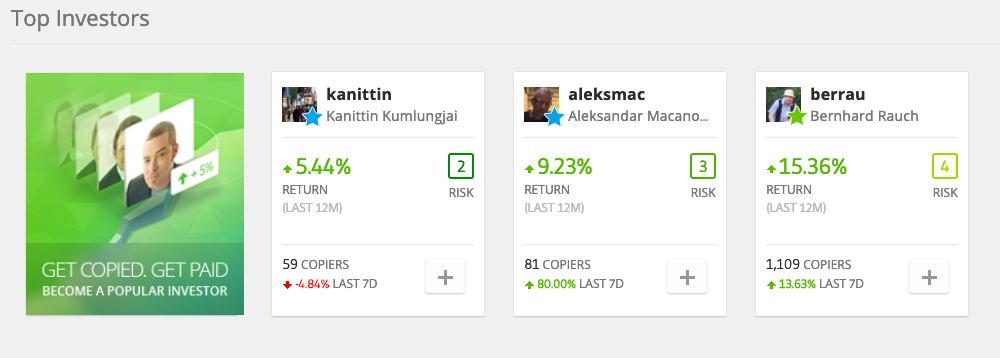

You’d think that the most copied people have lots of copiers for a reason, right? Do not follow the crowd. Before you delve neck-deep into the ‘ Copy People’ part, keep an eye out for a trader to copy. It’s intuitive to sort by ‘most copied’ and blindly copy the top results. But the reality is that most people on eToro are complete beginners and don’t really know what they are doing. If a few people copy a trader for the wrong reasons, that trader can quickly ‘go viral’ with exponentially more copiers. The one below is an example:

This trader has a poor performance so if you would’ve copied him, (you and he would have lost a large portion of your money), meanwhile, he still has hundreds of copiers. So look out for underperforming traders.

Furthermore, try not to engage in over-trading. It’s incredibly tempting to keep checking how much you’ve made or lost every few hours, but emotions will cloud your better judgment and lead to tinkering.

No trader will EVER profit every single week or month, so I highly recommend you take a medium/long-term approach. This requires patience and discipline, but you’re more likely to see better gains over time.

So how do you select the good traders, the ones worthy of attention and patience?

First off click on ‘Copy People’ on the eToro sidebar.

You can either simply scroll down the page to see promising and trending popular investors…

…or you can use the advanced search feature. Everything in blue you can change to meet the criteria you’re seeking in potential traders to copy.

Press ‘Go!’ for a list of matching traders, ordered by the number of copiers they have. To further drill down use the filters at the top.

There are 4 characteristics a trader should have

1, They must be active and have low weekly and daily drawdowns (basically how much they’ve been ‘down’ over a given period). Anything more than 10% should be a red flag

2, They must be on eToro for at least six months and haven’t just made amazing gains because of one or two lucky punts

3, Don’t have ridiculous returns or it may look suspicious. I know this may seem counter-intuitive, but if you see someone with 1,000%+ returns in a very short period of time, realize that this is unsustainable luck and can only be achieved by being reckless

4, Messaging. You want to copy someone who can help you learn and is willing to share their trading methodology. If they don’t reply to your messages they either don’t care (likely to trade carelessly too) or they don’t know how to answer because they don’t have a clue what they’re doing!

5, Demonstrate their market knowledge and experience on their profile feed

Viewing a trader’s past performance

Let us walk you through assessing an individual trader before outlining the exact steps to copy a trader, so you can understand what to look for and how the process works.

Viewing a trader’s stats

By clicking on the ‘stats’ tab in a trader’s profile you can access some very useful information to help determine whether they are worth copying or not.

Below you can see a trusted friend of mine, whom I copy due to my trust and his experiences. If you had copied him too with a deposit of $500 at the start of 2017, by year-end you’d have about $646. As mentioned earlier, such returns do come with risk too. For example, in the last three months of 2018, I had lost quite a fair amount of money.

There are two other key factors to keep an eye out for. There is the risk score indicating how risky a trader is and the max drawdown shows the maximum a trader has ‘been down’ in a single week during this period. Same idea for daily and yearly.

It’s interesting to compare the current risk to past months to see how their strategy has evolved. Anything green shows a very safe, low-risk low-return attitude.

The spectrum then moves through yellow, orange, red, and black where the risk factor is the highest. Anyone with low scores, more than 6 non-green bars should be avoided.

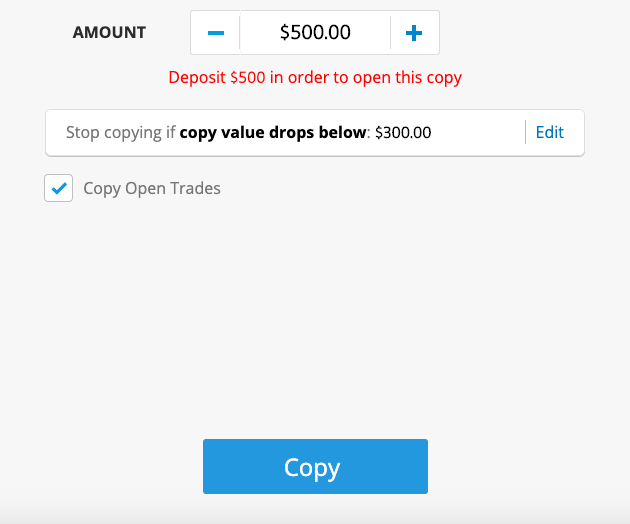

Copying traders, in general, is simple. Once you’ve found a trader who you feel is reliable, simply open their profile and click on the blue ‘Copy’ button.

You’ll then be prompted to enter an amount with which to copy that trader. I’d recommend $200 for starters. Also, before you start there will be a couple of questions popping up to analyze your knowledge and intent when trading. But they are unimportant, so you can skim through them.

A bit of math

Let’s do the math here. If you copy a trader with a minimum of $200 invested, then “Average copied trade size” leads us to how the copying actually works in real dollar terms. Each trade you copy would be (on average) $2,72. Proportionally this is just 2.72% of the total ($5.44 out of the $200) of your total investment in them. In this case, it’s a good sign as it shows a cautious and safe investment style.

You can also set a “stop-loss”, which is a protection against severe money loss set at 40%. If the person you are copying loses 40% of your investment, your account automatically stops copying them. You can set this level to whatever you want, depending on how much risk you’re prepared to take. However, I would recommend keeping this number closer to a 20% percent margin, as long as you feel like a beginner.

Monitoring your performance

Clicking on ‘Portfolio’ takes you to your open trades.

This is where the trading takes place, a real virtual marketplace with numbers dispersed across your screen, changing by the second. Here you can monitor all of your current open positions and close them, and also access a record of your trading history.

All of your copied traders and investments will be listed in your Portfolio. You can see your overall return on the investment in a trader, and also click on the person to see what positions they (and you) currently have open, and how these are performing individually.

Watchlist users

It’s worth noting that you can also just ‘follow’ traders (without copying or investing in them) so their updates show up in your Watchlist and News Feed It’s a good way to gauge whether you think they’re worth copying and tune into useful information.

How to Start a Good Trade

Once you’ve familiarized yourself with the eToro platform and (hopefully) had some success copying other people, you can start thinking about placing your own trades.

The good news is that you don’t have to be a financial genius with decades of experience to make money trading yourself.

The bad news is that you do need to think a bit harder and as highlighted earlier do your research! Any investment choice from now is on you!

Focus all your energies and chakra on the stock markets! It pays dividends to do your homework because there is no specific investment advice. There are several assumptions or guesses, but no direct A or B answers which stocks you should choose. Get used to the platform and the whole process of opening and closing positions without too much pressure.

What I can tell is to invest only in stocks or companies that you believe are in a strong and healthy position to resist market shocks, and ultimately have room to grow.

If you’re really serious, you might also want to read up on the price/earnings ratio to identify undervalued/overpriced stock.

How to place a trade

When you have built your profile and got yourself registered, you can click on ‘Trade Markets’, then ‘Stocks’, then ‘Industry’. Choose an industry, for example, ‘Technology.’

You will then be presented with a list of all financial stocks tradable on eToro. You will also see their respective prices and change over the past day.

Let’s pretend we want to buy some Yahoo stock, say $100 worth. Click on ‘AABA’ (this is the ticker used for Yahoo on the stock exchange) and you will first see the ‘Feed’. This displays all the latest news and insightful discussions surrounding the Yahoo share price and the company’s activity in general.

Click ‘Chart’ to display a chart showing the company’s stock prices over the last year. You’re able to change the period shown by zooming in and out.

If you want to invest in Yahoo (believing that the bar will rise), click on ‘Trade’ in the top right corner.

The minimum amount to trade is $100. Below this, you can set the amounts at which you automatically want to close the trade, for both loss and profit.

It is crucial to take note of the “Leverage” figure. The number refers to how much you can multiply your gains (and losses) by. A higher number equals higher risk.

X1 is essentially buying the real stock. If you traded at X2, any price movement is magnified by 2 (the value doubles. Usually, it’s automatically on X5, so for beginners, I’d suggest clicking on the number and reducing it to X1.

When you’re ready click ‘Set Order’.

That’s it! You have just made your first investment in Yahoo!!!

You can check your performance by clicking ‘Portfolio’ to see your open positions.

If you click on the Yahoo stock, you can see more info. In my case below, if I bought $100 worth this April and it shows my current percentage earned on this trade (P/L %), which would translate to a certain value earned (P/L $).

Don’t look for short-term gains. Be confident that over the longer term the value of your portfolio will rise. It’s patience that has served me well since I did not aim at making a big buck over the months. Don’t make rash decisions just because a company released some ‘bad’ news and the market overreacted in the short-term. This is not a crypto trading platform. 😛

Keep in mind that the markets tend to fluctuate and there are sometimes downturns, with the overall long-term trend is upwards. Even the best traders in the world will have some fluctuations, but most copiers lose money by copying at the peaks and stop copying shortly after because they’re down a few dollars.

Cost of Trading

All trades charge both a spread and daily rollover fees. The rollover fees are small costs, proportional to the size of the trade you are opening and the level of risk. It’s important to know that these fees are constantly changing depending on market conditions and may either be a fee or a credit.

The ‘spread’ is the small difference between the buy and sell price that all brokers offer – this is how they make their money and similar in magnitude to the markup for stocks. You will be charged this when you close a position.

One way to minimize the spread fees is not to over-trade. It’s also worth mentioning that if you become a popular investor you can get a partial or even total rebate on these fees.

This is understandable from Etoro’s perspective. Just like any for-profit company, eToro provides its services to make money. The costs of trading here are far less than traditional stockbrokers, crypto platforms, and fund managers. This is one reason why I recommend you stick to this market when starting out.

When copying another user you’ll be charged the same fees as they are on trades, so it’s worth checking your portfolio to see what positions they have opened.

The only other fee you will encounter on eToro is the withdrawal fee if you want to transfer funds out of your account.

Be aware that even though everyone is out there to grab money, this is a community after all. Everyone aims to show their best color and gain followers. This cannot be done if you try to put everyone out of your way.

With all this in mind, I wish you good luck! 🙂