In almost every article you read about small businesses, you will notice a recommendation to hire an accountant or a CPA firm – because it is a sad fact that around 80% of all American companies will fail within the first 18 months.

One of the root causes of that is poor financial management.

Poor financial management means that the company can never be sure when they have money coming in when they have bills to pay, won’t be keeping good business finance records, and filing time will be hectic.

It is estimated that a vast 50 +% of small business owners don’t have an accountant at all, and a large portion of them don’t use any sort of accountancy software to help them track their finances.

All of this is a recipe for disaster, so what is the real impact of a good accountant, and could it help save your small business?

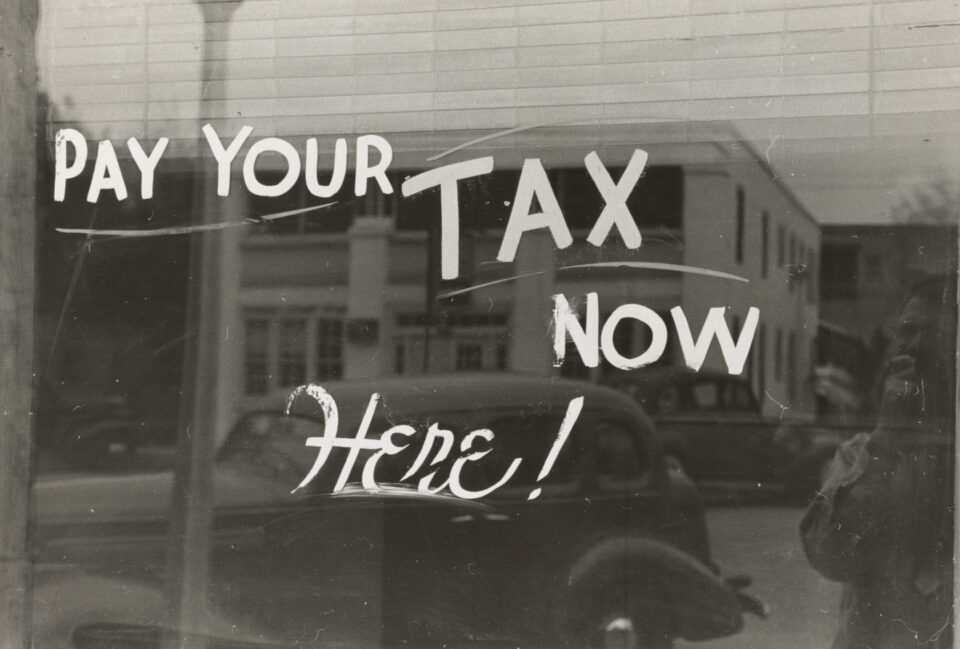

Deductions

Almost all business owners are looking at how they can use their deductions. When it comes to filing at tax season, you’re probably not going to remember the lunch that you bought a client in early February.

You will likely not remember the software you tried for three months during the year and didn’t like.

If you work with an accountant or CPA firm, they can support you by highlighting all potential deductions throughout the year. They can also help you to make strategic decisions when it comes to your year-end deductions.

Save time and money

Suppose you consider all of the hours you need to spend preparing your taxes as money and time. In that case, you are going to realize very quickly that an accountant will save you a lot of both. You can focus on your business while they take care of all of the financial information regarding filing your taxes.

That’s not even to mention all of the mistakes that are possible to make when filing your own taxes and possibly ending up with a costly fine at the end of it.

And it’s certainly it shouldn’t be taken for granted that when you have an accountant or a CPA firm do your accounting, you are less likely to need to have an audit.

All this can often be avoided if you have the guidance of a CPA firm all year round.

Future business decisions

Every day, you will be required to make future business decisions, and the more information you have available, the better decisions you can make.

An accountant will not only highlight all of your potential opportunities, but they can also help you avoid making bad business decisions. They can take an objective look at the big picture of your business and help you find the best way to make sure that you’re in it for the long run.

A good accountant can make sure that your company is financially healthy now and in the future. They can also make sure that you keep your assets protected, too – although it pays for you to know how to do it too: How to Protect your Personal Finances as a Business Owner – Times International.