Investing in used industrial equipment can be a cost-effective way for businesses to access the machinery they need for production without the steep prices of brand-new gear. While the initial savings are apparent, calculating the true long-term return on investment (ROI) requires a deeper analysis.

Factors like equipment condition, depreciation, the costs of maintenance, and the pace at which technology becomes outdated all play significant roles in determining ROI. This article delves into some of these complex variables to help you make informed decisions about your industrial equipment investments. Keep reading to learn how to assess the value and maximize the return on your assets.

Understanding the Value of Used Industrial Equipment in Modern Production

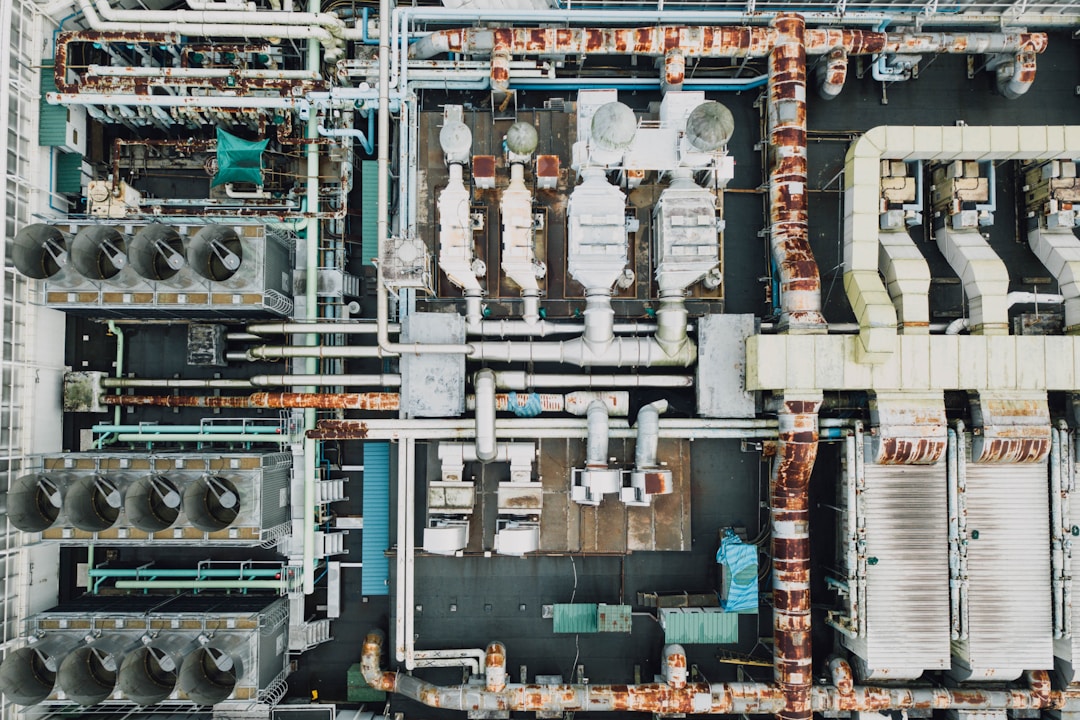

Industrial companies seeking competitive edges often turn to used machinery and refrigeration equipment for sale as a practical alternative to new equipment. The aftermarket for industrial gear is extensive, offering a wide range of tools necessary for diverse production operations. By opting for used machinery, businesses can significantly reduce capital expenditure while still fulfilling their manufacturing requirements.

However, the true value of used equipment extends beyond the initial price tag. It includes the potential longevity of the machinery, its performance in a production setting, and the overall impact on manufacturing efficiency. A judicious selection of quality used industrial tools can yield long-term advantages, maintaining high productivity standards.

When acquiring used industrial machinery, factors such as compatibility with existing production lines, ease of integration, and scalability should be taken into account. These elements influence whether the investment aligns with strategic business goals and can lead to improved throughput and quality of output.

Used refrigeration equipment can be a critical component in the food processing sector. Proper evaluation ensures that even second-hand equipment meets industry regulations and safety standards, contributing positively to the ROI equation.

Maintenance Considerations for Used Industrial Equipment and ROI

Maintenance is a critical factor when it comes to determining the ROI of used industrial equipment. Regular upkeep can extend the life of machinery, ensuring it remains productive and reliable over longer periods. This attention to maintenance can mitigate the effects of depreciation and add to the asset’s residual value.

On the contrary, neglecting maintenance can lead to unexpected breakdowns, increased downtime, and potentially costly repairs, which can quickly erode the initial savings realized from purchasing used equipment. Implementing a proactive maintenance schedule is not only prudent but also cost-effective over the equipment’s lifespan.

It’s essential to consider the availability of parts and the knowledge required to maintain older equipment. In some instances, older machinery may require specialized skills or hard-to-find parts, which could increase the total cost of ownership (TCO) and diminish ROI.

Furthermore, documentation from previous owners regarding the maintenance history can provide valuable information and should be a part of the buying criteria. Equipment with a well-documented service history can assure buyers of its reliability and a potentially higher return on investment.

Best Practices for Assessing and Maximizing Long-Term ROI

To maximize the long-term ROI of used industrial equipment, performing a thorough pre-purchase assessment is essential. This includes evaluating the machinery’s current condition, estimating maintenance costs, and considering its viability in your specific production environment.

Building a relationship with reputable suppliers of used industrial machinery can also contribute to better ROI. Trusted vendors not only provide quality equipment but also valuable insights into the performance and potential longevity of the machinery they sell.

Additionally, factoring in the resale value as part of the initial purchase decision can be wise. Understanding how quickly an asset might depreciate and its potential market demand at the end of your use can inform more strategic buying decisions.

Lastly, staying informed on industry technology trends aids in making proactive decisions on when to upgrade equipment. Adopting a lifecycle approach to asset management, where regular reviews of equipment effectiveness and efficiency are performed, ensures continuous alignment with business goals and optimal ROI.

The decision to invest in used industrial equipment comes with many considerations that all contribute to the eventual ROI.